Around 13,000 UK companies previously classed as “medium” and subject to a statutory audit will now fall within the “small” threshold, negating the need for an audit, and 113,000 companies previously classified as “small” will now be eligible to be treated as “micro,” which enables simpler company accounts with less disclosure to be filed.

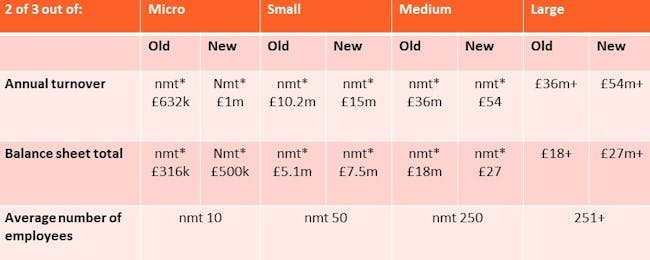

At present, companies that meet 2 out of 3 size criteria for 2 consecutive years would be subject to the requirements of their size bracket – see the table below.

*nmt = not more than

Previously, if a company had two out of the three or more than £10.2m in turnover, £5.1m in gross assets and more than 50 employees for 2 years in a row, the company would have been required to have a statutory audit carried out. These financial thresholds, as well as the thresholds for every other category, will increase by 50%.

Whilst a company can never use the framework for a size bracket below (I.e. a company that qualifies as small cannot use the micro framework), companies can choose to move up the size bracket, and there are several reasons why a company that qualifies as “micro” may actually wish to operate under the “small” reporting framework. Your accountant will be best positioned to guide you on this.

Dates and full details are yet to be announced, but the largest tangible benefit will likely come from companies that now qualify as small, having previously been classified as medium, and are therefore no longer required by law to have an audit carried out.

Professional advice should always be taken well in advance when it comes to assessing the thresholds, particularly when it comes to determining whether an audit is going to be required by law.