Pre-Notification of Claim

Companies making their first R&D claim or those which have not claimed within the previous three accounting periods must notify HMRC of the intention to make a claim. This must be completed via an online form, within six months of the end of the accounting period to which the claim relates.

If the pre-notification is not made, or if the deadline is missed, HMRC will deny the company the ability to make an R&D claim for that period.

Companies that have claimed in one of the preceding three periods will not need to pre-notify.

Mandatory Additional Information

From 8 August 2023, all R&D claims will have to be made digitally, and the claiming company will be required to submit an ‘additional information form’ which will need to include information such as; a breakdown of the costs claimed across the qualifying categories of expenditure, detailed descriptions of the R&D activities undertaken and details of a named senior officer of the company. All claims will also require details of any agent (or tax adviser) who has assisted the company with the claim.

Rate changes

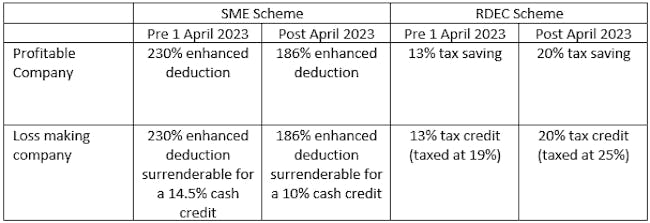

The 1 April 2023 has brought a host of changes to the rates applicable to R&D tax relief, which coincided with the increase to Corporation Tax. The table below summarises the relief available to Small and Medium sized companies, under the SME Scheme, and to Large Companies under the RDEC scheme.

R&D Intensive Companies

R&D intensive SME companies are those whose qualifying R&D expenditure constitutes at least 40% of total expenditure, these companies, should they be loss making will benefit from an increased cash credit rate of 14.5% on its enhanced expenditure at 186%.

Visit our full guide to R&D tax credits to learn how your business could benefit.